GST disruption slows FMCG sales in September quarter

As markets prepared for the new GST rates to kick in from Sept 22, consumers delayed buys to avail benefits of the reduced prices while retailers slowed stocking up shelves, hitting sales of FMCG companies such as HUL and Colgate Palmolive (India).

As markets prepared for the new GST rates to kick in from Sept 22, consumers delayed buys to avail benefits of the reduced prices while retailers slowed stocking up shelves, hitting sales of FMCG companies such as HUL and Colgate Palmolive (India).

Value growth stood at 12.9% in the quarter, led by a 7.1% increase in prices and down marginally over the previous quarter.

“With inflation easing, the outlook for consumption remains optimistic and the impact of GST changes on consumption is expected in the next two quarters,” said Sharang Pant, head of customer success, FMCG, NielsenIQ in India.

Value growth and volume growth stood at 5.3% and 3.5%, respectively, in the year-ago period.

Govt cut GST rates on a host of essentials and regular household items to spur consumption; companies are passing on the benefits through a mix of price cuts and grammage increases.

Firms had earlier said that markets would resume normal operations from Nov.

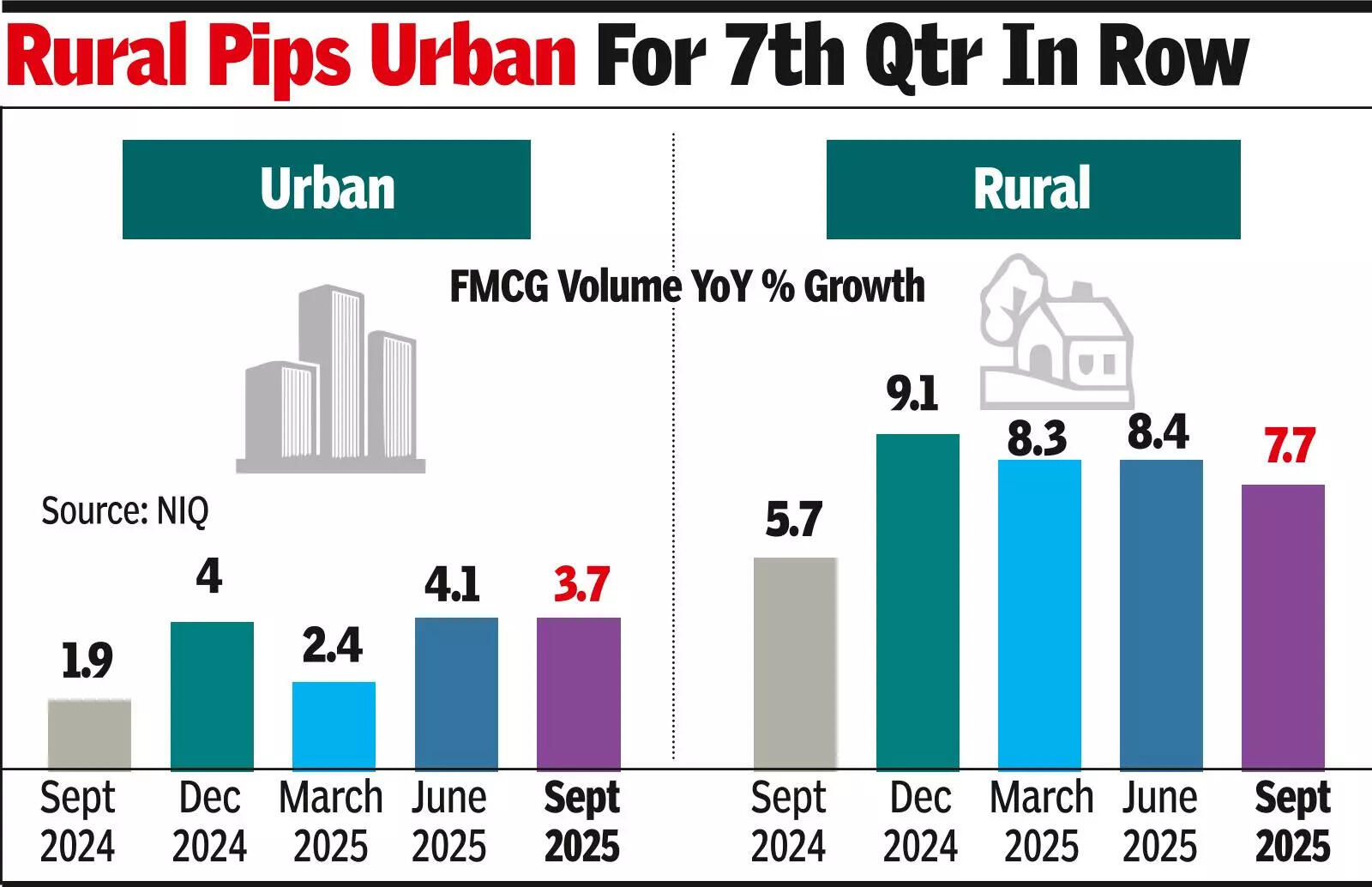

Even at a slower pace of consumption, rural India grew ahead of urban for the seventh straight quarter, driving FMCG volumes in the July-Sept period.

Rural volumes increased by 7.7%, lower than the 8.4% growth recorded in the preceding quarter but higher than urban’s 3.7% expansion. In urban India, smaller towns are leading the demand recovery given that the shift to online channels is not yet as rampant as in the metros where people are increasingly shifting to quick commerce platforms.

NIQ typically doesn’t combine the online and offline retail sales data.“Metropolitan areas continue to experience a decline in offline sales owing to a shift towards e-comm,” analysts at NIQ said, adding that the top eight metros lead online adoption.

In Delhi-NCR and Kolkata, for instance, e-commerce growth has surpassed that of modern trade channels.

Broader consumption has been tepid over the past few quarters weighed down by weak urban demand where high inflation had hit spending. Companies are betting on low inflation, GST cuts and income tax benefits to fuel demand going ahead with market leader HUL hinting at a better second half this FY.

“Sustaining this momentum will rneed deeper channel engagement and sharper, value-led propositions.

The industry is entering a phase where agility and consumer-centric innovation will be critical to future success,” NIQ said.