RBI may have to inject another dose of liquidity in Q4: Analysts

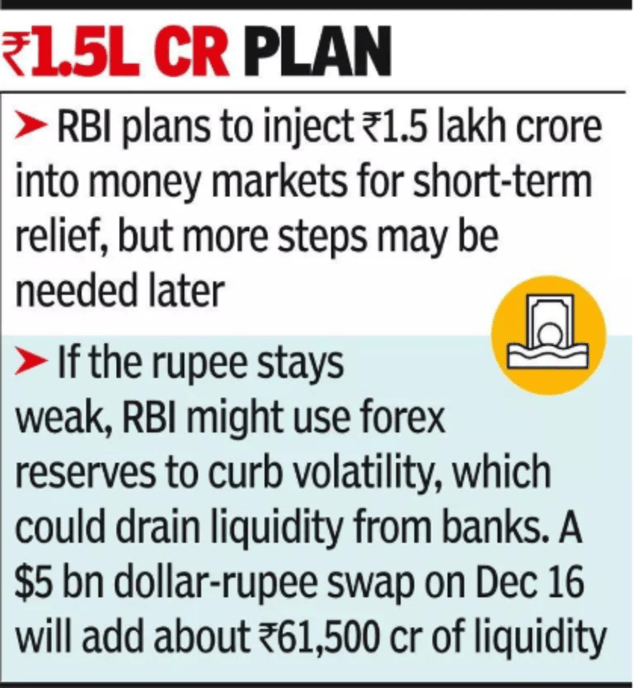

If the rupee remains under pressure, RBI may need to use its reserves to limit volatility, which will pull liquidity out of the banking system.To ensure that the quarter-percentage point interest rate cut announced on Friday gets passed on to borrowers and depositors, the central bank has signalled that it will maintain surplus liquidity at 1% of bank deposits, implying a requirement of about Rs 2.4 lakh crore.“Liquidity easing measures announced by RBI (OMO buys of Rs 1 lakh crore and $5 billion of forex swap of 3-year maturity) were expected and we anticipate Rs 1.5 lakh crore at the start of next calendar year with central bank targeting 1%/NDTL surplus; Similar mix of measures could be announced,” ICICI Securities said.

If the rupee remains under pressure, RBI may need to use its reserves to limit volatility, which will pull liquidity out of the banking system.To ensure that the quarter-percentage point interest rate cut announced on Friday gets passed on to borrowers and depositors, the central bank has signalled that it will maintain surplus liquidity at 1% of bank deposits, implying a requirement of about Rs 2.4 lakh crore.“Liquidity easing measures announced by RBI (OMO buys of Rs 1 lakh crore and $5 billion of forex swap of 3-year maturity) were expected and we anticipate Rs 1.5 lakh crore at the start of next calendar year with central bank targeting 1%/NDTL surplus; Similar mix of measures could be announced,” ICICI Securities said.

The Rs 1.5-lakh-crore infusion will come partly from bond buybacks and the rupee equivalent of $5 billion from a dollar-rupee buy/sell swap auction.

Under this swap, RBI will buy dollars from banks and return them after three years at a fixed rate.

According to Madhavi Arora of Emkay Global, an additional Rs 50,000-80,000 crore may still be needed in the fourth quarter depending on the scale of balance of payments pressures and the extent of RBI’s foreign exchange operations.

“Even so, this injection should meaningfully aid transmission, particularly as foreign exchange intervention is likely to continue, making the liquidity support especially timely and effective at this stage of the cycle,” she said.The $5 billion dollar/rupee swap scheduled for Dec 16, 2025 will add about Rs 61,500 crore of durable rupee liquidity to the banking system without permanently reducing forex reserves.

The rupee may weaken modestly in the short term as higher liquidity narrows the interest rate gap with the US.