Budget 2026: Why standard deduction should be hiked under the new income tax regime – explained

Table of Contents

ToggleBudget

2026: Why standard deduction should be hiked under the new income tax regime – explained” title=”<p>The standard deduction limit varies depending on the tax regime that salaried taxpayers opt for.

(AI image)<br></p>” decoding=”async” fetchpriority=”high”/>

As the government pushes for the adoption of the new income tax regime, any major changes including those in standard deduction limits, are expected only in that regime.Over the last few years, several income tax slab and rate changes have been introduced in the new regime to make it more attractive for salaried individuals.

Last year, FM Sitharaman made income up to Rs 12 lakh tax free (Rs 12.75 lakh for salaried taxpayers who get the benefit of Rs 75,000 standard deduction).

As per government data, for FY 2023-24, 72% of taxpayers had opted for the new regime – a figure that will likely go up after last year’s tax relief under the new regime.

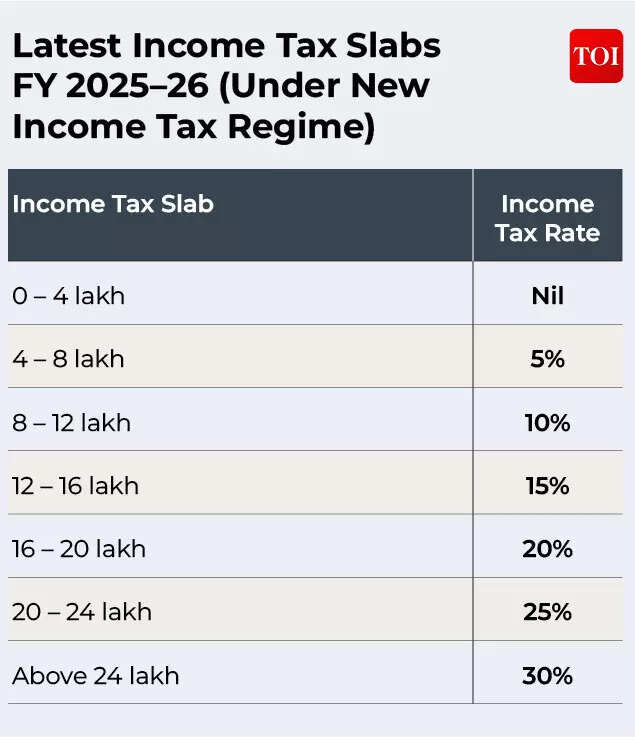

Latest Income Tax Slabs FY 2025–26 (Under New Income Tax Regime)

So, should the standard deduction limit be raised from Rs 75,000?

Most tax experts surveyed by Times of India Online are of the view that a hike in standard deduction under the new income tax regime should be considered by the government.

Why Standard Deduction Should Be Hiked

The case for a hike in standard deduction limits is simple: the new income tax regime does not offer benefits of most deductions and exemptions that are available under the old income tax regime.

Hiking this limit will push more people to opt to the clutter-free new income tax regime.

Some experts also advocate linking standard deduction limits to inflation, hence ensuring that the limit is in line with the rising cost of living.Preeti Sharma, Partner – Tax and Regulatory Services at BDO India tells TOI, “Under the new tax regime, salaried taxpayers currently enjoy a standard deduction of Rs 75,000, raised from Rs 50,000 in Budget 2025.

This increase has provided some relief, especially since most exemptions and deductions are not available under the new tax regime.

However, rising inflation and higher day-to-day expenses have reduced the disposable income of salaried households. A further increase in the standard deduction would help employees manage these rising costs.”Radhika Viswanathan, Executive Director at Deloitte India sees a case for standard deduction to be hiked to as much as Rs 1.25 lakh!“There is a strong case for further enhancing the standard deduction under the new tax regime since no other major deductions or exemptions are available to the salaried class.

While the current limit stands at Rs 75,000, the government could consider increasing it to Rs 1 lakh to 1.25 lakh.

An increase would provide meaningful relief, support middle-class taxpayers, and preserve the simplicity of the regime without reintroducing multiple deduction-linked compliances,” she tells TOI.

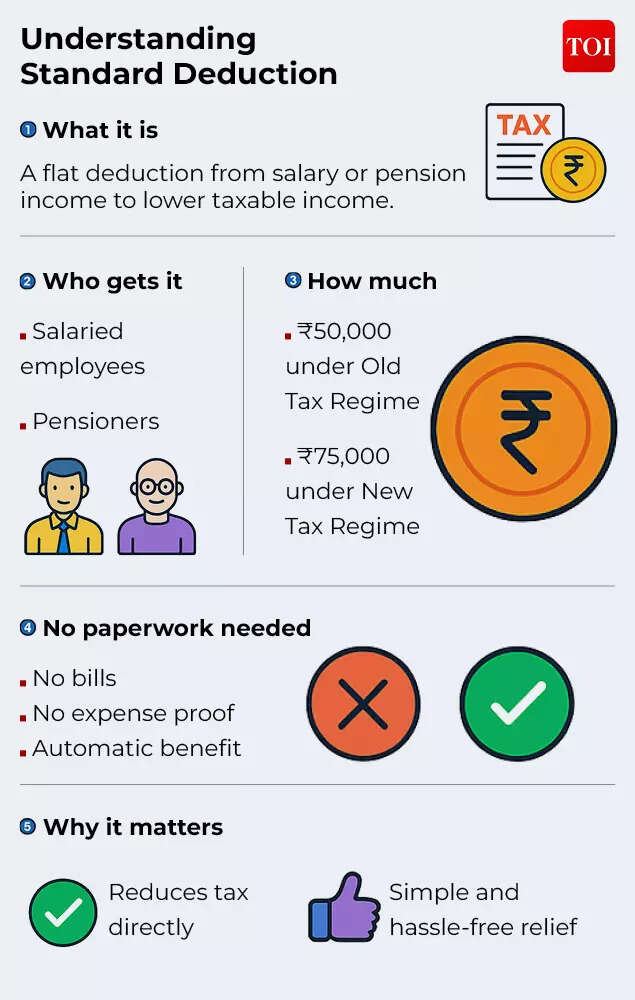

What is Standard Deduction?

Chander Talreja, Partner, Vialto Partners makes an important point: introduction of new labour codes may reduce take home pay, and an increase in standard deduction may help offset that.“This Budget will focus on how to further accelerate adoption of the new personal tax regime by the taxpayers.

On the one hand, the scope for further rationalization of tax slabs or the introduction of reduced tax rates and additional rebates is limited, as these were revised last year only.

On the other hand, introducing new deductions or exemptions under the new personal tax regime may not be feasible, given that the regime is designed to operate without such provisions, and any deviation could dilute its core objective,” he says.According to Talreja, this effectively leaves the government with one viable option – enhancement of the standard deduction.

The existing limit is Rs 75,000 under the new personal tax regime which may be increased by at least Rs 15,000 to address rising cost-of-living pressures.“Moreover, the said increase in standard deduction may also be crucial with the introduction of the new Labour Codes.

With the definition of “Wages” the contribution towards provident fund may go up which may consequently reduce the take-home pay for individuals.

Some relief in the form of increased standard deduction may help to offset this impact,” he says.Tanu Gupta, Partner at Mainstay Tax Advisors LLP also finds merit in increasing the standard deduction limit.

“In last year’s Budget, the government revised the income tax slabs under the new tax regime and enhanced the rebate under Section 87A, effectively providing tax relief for income up to Rs 12 lakh (Rs 12.75 lakh for salaried taxpayers).

The objective was to increase disposable income, thereby boosting consumption. This was further supplemented during the year by reductions in GST on several items,” she tells TOI.However, the standard deduction, which was increased from Rs 50,000 to Rs 75,000 in Union Budget 2024 under the new tax regime, has since remained unchanged, she says.

“There is merit in automatically adjusting this limit each year for inflation, in a manner similar to the government’s periodic revision of Dearness Allowance for its employees.Given the limited number of exemptions and deductions available under the new tax regime, such simplicity – combined with automatic inflation adjustment – would make the regime even more straightforward and taxpayer-friendly,” she adds.Parizad Sirwalla, Partner and Head, Global Mobility Services, Tax at KPMG in India is also of the view that since salaried taxpayers do not have any avenue to claim deduction for increased cost of living / other expenses (unlike a person earning business income) there is an ongoing expectation that the standard deduction is enhanced periodically keeping in mind the rate of inflation prevailing in the economy.

Why the government may not hike standard deduction limit

However, some experts note that the government will have limited fiscal room to hike standard deduction after last year’s tax slab changes under the new income tax regime and sweeping GST rate cuts.

There is also the rationale that the government may await data on how many taxpayers opt for the new tax regime as per FY 2025-26 slabs before looking to incentivise it further.Richa Sawhney, Partner, Tax at Grant Thornton Bharat explains that salaried taxpayers often feel that they end up paying more taxes than taxpayers with business income, due to limited avenues of deductions available from salary income.

Why Standard Deduction Should Be Hiked & Why It May Not Be

Standard deduction is one of the limited deductions available to salaried taxpayers, which aims to compensate them for employment‑related expenses, without requiring proof of claim.

“Salaried taxpayers do feel that the current limit of Rs 75,000 is inadequate and a hike is surely on their budget wishlist .

However, considering that the standard deduction was enhanced last year, increasing it further this year may not be feasible for the government.

More-so, when the softening of gross non corporate tax collections is evident post the slab rate reforms carried out last year,” she says.Surabhi Marwah, Tax Partner, EY India also says that a further hike in the standard deduction appears unlikely in the near term.

“In Budget 2024, the government increased the standard deduction under the new tax regime to Rs 75,000 for salaried taxpayers, while the old regime continues to offer Rs 50,000.

This differential already provides a clear incentive for taxpayers to shift to the new regime,” she tells TOI.“With the Income-tax Act 2025 focusing on structural simplification, the priority now seems to be on wider adoption of the revised framework rather than introducing additional reliefs,” she adds.