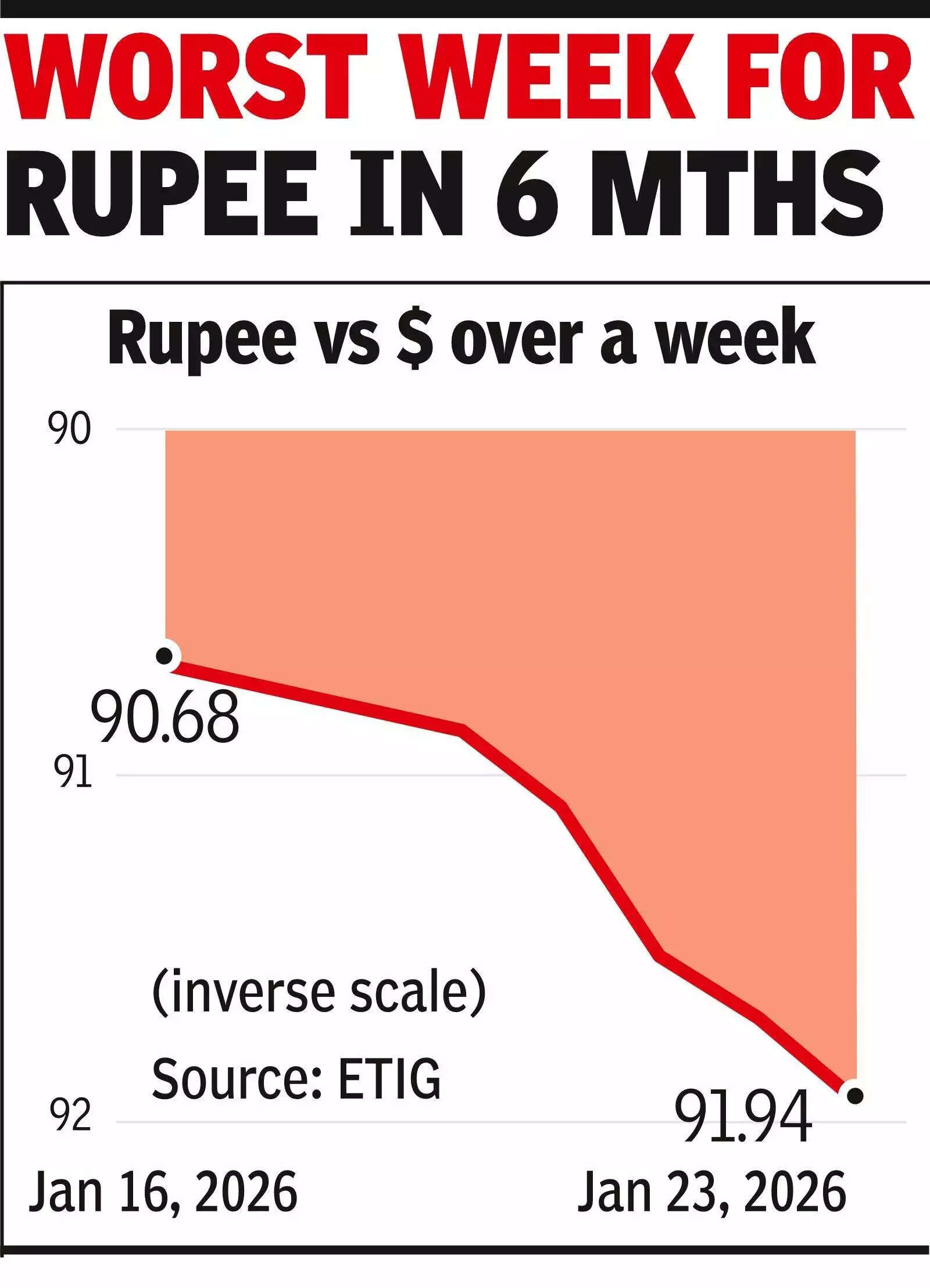

All in a day: Rupee nears 92/$, RBI eases liquidity, forex kitty swells

The rupee slipped close to the 92 mark before ending the day at 91.94 against the dollar, down 24 paise.

The rupee slipped close to the 92 mark before ending the day at 91.94 against the dollar, down 24 paise.

The fall marked its sharpest weekly decline in six months, driven by steady foreign outflows, costlier crude oil and higher global bond yields.Intervention by the central bank slowed the fall but could not reverse the broader weakness, especially as equity markets remained under pressure from foreign selling.

.

Normally, when RBI sells dollars to defend its currency, it pulls rupees out of the banking system.

This tightening of liquidity tends to push up short-term interest rates, making it more expensive to bet against the currency.

This time, however, RBI chose a different approach.

To prevent borrowing costs from rising and to keep bond yields under control, it announced steps to inject about Rs 2.15 lakh crore into the banking system. These included a $10-billion dollar-rupee swap.The swap, in particular, explains another apparent puzzle.

Under this arrangement, banks sell dollars to the central bank and receive rupees, with an agreement to reverse the transaction after three years.

This adds rupee liquidity immediately and dollars to the forex reserves, even though the central bank may be selling dollars in the spot market to steady the currency.

As a result, foreign exchange reserves rose sharply to $701.4 billion as of Jan 16, an increase of $14.2 billion in a week.Taken together, the moves highlight the balancing act facing policymakers – containing currency weakness, keeping interest rates from rising too sharply, and maintaining a strong reserve buffer that can grow even when the rupee is under pressure.