‘Dollar assets gain favour among India’s wealthy as Rupee depreciates’

Equities continue to remain the preferred asset class, with physical real estate close behind.

Equities continue to remain the preferred asset class, with physical real estate close behind.

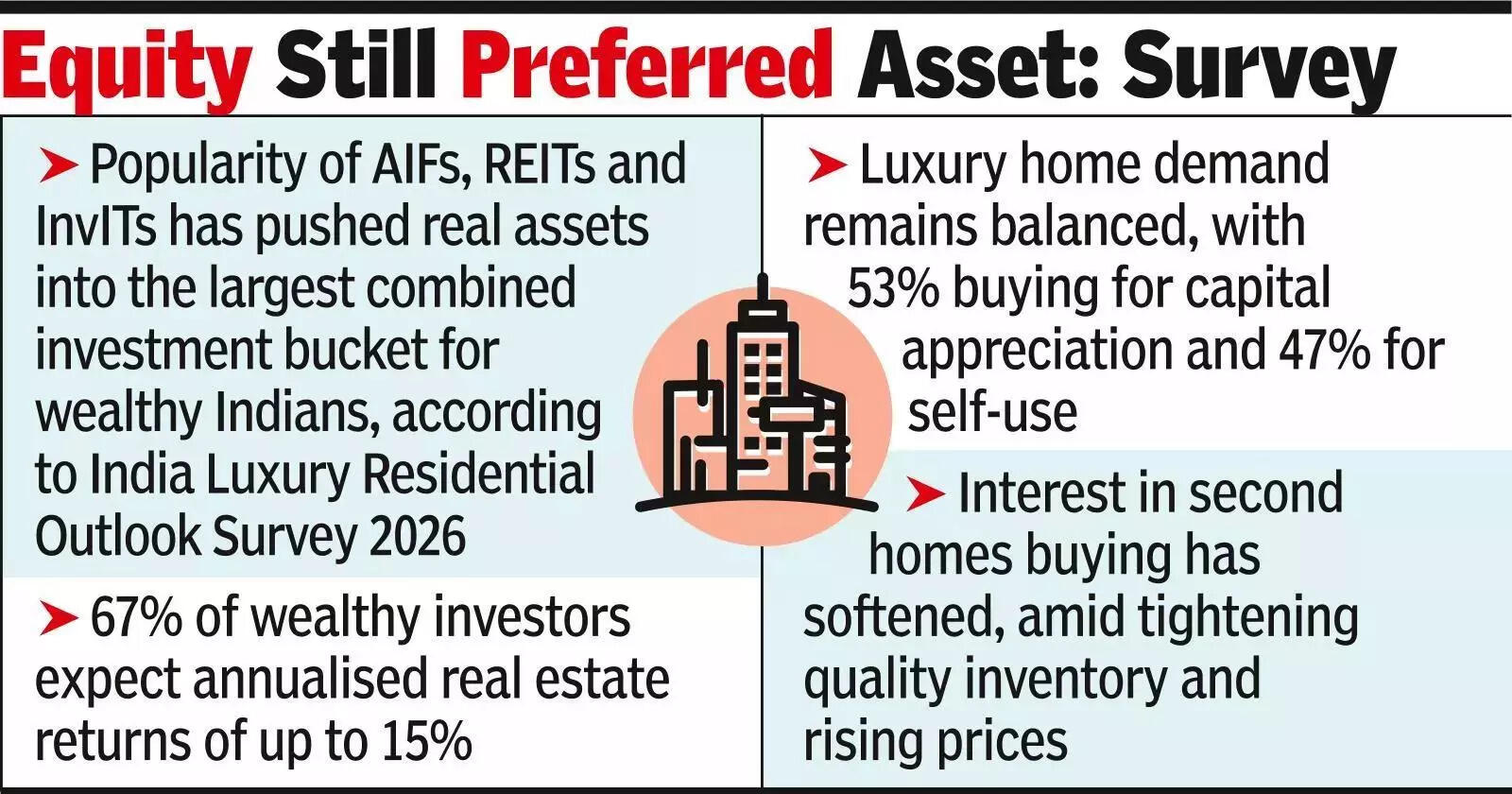

The rising popularity of AIFs (Alternative Investment Funds), REITs (Real Estate Investment Trusts) and InvITs (Infrastructure Investment Trusts) has pushed real assets into the largest combined investment bucket for wealthy Indians, the report showed.

Over the past two years, real estate buys have been evenly split between homes bought for personal use and those made as investments, reflecting a balanced approach that combines lifestyle aspirations with long-term returns.

.

The annual survey showed that 67% of high net-worth individuals (HNIs) and ultra-high net-worth individuals (UHNIs) remain bullish on India’s growth prospects over the next 12-24 months, despite global economic headwinds.

At the same time, expectations have moderated, with 72% of respondents forecasting India’s GDP growth in the 6-7% range in FY27, compared with earlier expectations of growth above 7%.The report points to sustained confidence in luxury housing, even as buying decisions become more cautious.

Over last two years, luxury residential buys have been almost evenly split between capital appreciation and self-use, with 53% of buyers investing for returns and 47% purchasing homes for personal use.

City-based luxury homes continue to dominate buyer preferences, with 31% prioritising primary residences and 30% focusing on investment-led residential assets.However, interest in second and holiday homes has softened.

Only 25% of respondents reported purchasing a second home in the past 12 months, amid tightening quality inventory and rising prices.

Among those who invested, farmhouses on city peripheries emerged as the most preferred option at 46%, followed by mountain destinations at 33%.