Sebi lines up reforms to boost investment, woo foreign funds

The Sebi chief also said that the regulator was working on a plan to introduce a closing auction mechanism for stock market trading that could aid in better price discovery.

The Sebi chief also said that the regulator was working on a plan to introduce a closing auction mechanism for stock market trading that could aid in better price discovery.

Pandey insisted that factors like stock returns and global economic conditions are the primary drivers for foreign funds to invest in a country, rather than regulatory conditions.

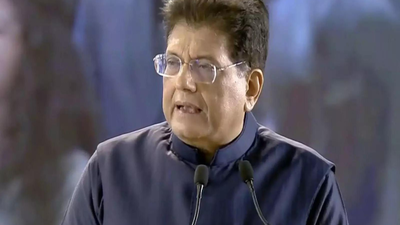

The Sebi chief was speaking at the regulator’s Samvad annual conference in the city.

The top regulator said it is working to put in place a technology roadmap for market infrastructure institutions (MIIs, like stock exchanges, depositories, clearing corporations etc) that will provide “a structured short-term as well as long-term strategic technology vision for the securities market ecosystem and further enhance its resilience.“Touching upon the country’s robust IPO scene, the Pandey said record volumes of fund-raise from the equity market for the second consecutive year reflected “issuer confidence that Indian markets can deliver scale, efficiency, and long-term capital.” Later in the day, Sebi allowed an auction mechanism for closing prices, a global best practice, for the Indian market.

This will allow a better price discovery.

The overhaul is aimed at making markets deeper and attracting foreign investors.