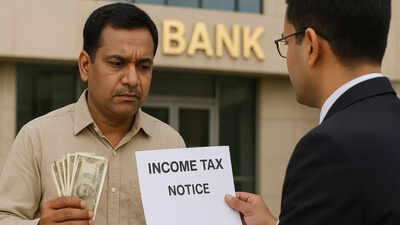

Rs 8 lakh cash deposited in bank – man gets tax notice! Assessing officer deems it presumptive business income, but taxpayer wins case in ITAT – ruling explained

During the assessment, the AO estimated Kumar’s business income under Section 44AD — something completely outside the scope of the original notice. (AI image) Making cash deposits of large amounts in your bank account? Be aware of a case where a cash deposit attracted the attention of the Income Tax Department, and the assessing officer…